Form 1040 SR, U S Tax Return for Seniors Internal Revenue Code 2022

What is the IRS 1040 SR Form?

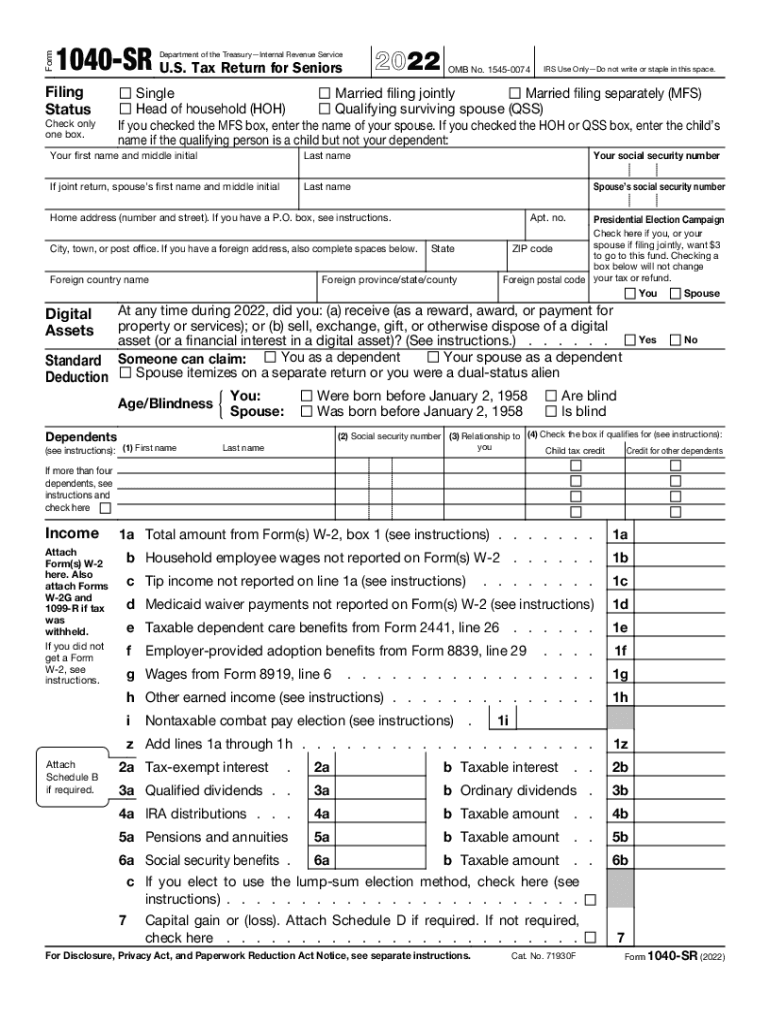

The IRS 1040 SR form is specifically designed for seniors aged sixty-five and older, allowing them to file their federal income tax returns. This form is a simplified version of the standard IRS 1040 form, tailored to meet the needs of older taxpayers. It includes larger print for easier readability and provides a straightforward way to report income, deductions, and credits. The 1040 SR form can accommodate various income sources, including pensions, Social Security benefits, and retirement account distributions.

How to Use the IRS 1040 SR Form

Using the IRS 1040 SR form involves several steps that ensure accurate reporting of income and deductions. Taxpayers begin by gathering necessary financial documents, such as W-2s and 1099s. After filling out the form with personal information, income details, and applicable deductions, taxpayers can calculate their tax liability. The 1040 SR allows for standard deductions, which simplifies the process for many seniors. Once completed, the form can be submitted electronically or via mail, depending on the taxpayer's preference.

Steps to Complete the IRS 1040 SR Form

Completing the IRS 1040 SR form involves a series of organized steps:

- Gather necessary documents, including income statements and previous tax returns.

- Fill in personal information, such as name, address, and Social Security number.

- Report all sources of income, including wages, pensions, and Social Security benefits.

- Claim deductions, opting for the standard deduction or itemizing if beneficial.

- Calculate total tax liability and any refundable credits.

- Review the form for accuracy before submission.

How to Obtain the IRS 1040 SR Form

The IRS 1040 SR form can be easily obtained through various means. Taxpayers can download a printable version directly from the IRS website in PDF format. Alternatively, physical copies are available at local IRS offices and some public libraries. Many tax preparation software programs also include the 1040 SR, allowing users to fill it out electronically. This accessibility ensures that seniors can obtain the form conveniently and without unnecessary complications.

Legal Use of the IRS 1040 SR Form

The IRS 1040 SR form is legally recognized for filing federal income taxes for eligible seniors. To ensure compliance, it is important to follow IRS guidelines and accurately report all income and deductions. The form must be signed and dated by the taxpayer, and any electronic submissions must adhere to eSignature regulations. Utilizing a trusted platform for electronic filing can enhance security and ensure that the submission meets all legal requirements.

Filing Deadlines and Important Dates

Filing deadlines for the IRS 1040 SR form typically align with the standard tax deadlines. For most taxpayers, the deadline to file is April fifteenth of the following year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. Seniors should also be aware of potential extensions available through the IRS, which can provide additional time to file their returns without incurring penalties.

Quick guide on how to complete form 1040 sr us tax return for seniors internal revenue code

Effortlessly Prepare Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code on Any Device

Managing documents online has gained popularity among enterprises and individuals. It offers an ideal environmentally-friendly substitute to standard printed and signed forms, allowing you to obtain the necessary document and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly without delays. Handle Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code on any device with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Modify and eSign Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code with Ease

- Obtain Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your edits.

- Select your preferred delivery method for your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

No more worrying about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in just a few clicks from your chosen device. Edit and eSign Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code to maintain effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form 1040 sr us tax return for seniors internal revenue code

Create this form in 5 minutes!

People also ask

-

What is the IRS 1040 SR printable form?

The IRS 1040 SR printable form is a simplified tax return form designed for seniors aged 65 and older. It allows eligible taxpayers to report income and deductions easily while taking advantage of special benefits. Using this form can streamline the tax filing process for those who qualify, making it a valuable resource.

-

How can I access the IRS 1040 SR printable form through airSlate SignNow?

You can easily access the IRS 1040 SR printable form using airSlate SignNow by navigating to our document library. Our platform provides seamless access to various tax forms, including the 1040 SR, ensuring you can complete your tax filings conveniently. Simply upload the form and start filling it out online for eSigning options.

-

Is there a cost to use airSlate SignNow for the IRS 1040 SR printable form?

Yes, airSlate SignNow offers various pricing plans, including options to use our services for IRS 1040 SR printable forms. We provide a cost-effective solution for businesses and individuals looking to streamline document sending and signing. Visit our pricing page for detailed plans that suit your needs.

-

What features does airSlate SignNow offer for managing the IRS 1040 SR printable form?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking to manage your IRS 1040 SR printable form. You can fill out the form online, ensure compliance with federal regulations, and securely store your documents. The platform enhances efficiency and saves time during tax season.

-

Can I integrate airSlate SignNow with other software for handling the IRS 1040 SR printable form?

Absolutely! airSlate SignNow supports integrations with various software applications, making it easier to manage your IRS 1040 SR printable form within your existing workflow. Whether you use accounting tools or CRM systems, our platform can connect to simplify your document management process.

-

What benefits do I get by using airSlate SignNow for the IRS 1040 SR printable form?

Using airSlate SignNow for the IRS 1040 SR printable form allows for efficiency, security, and ease of use. You can electronically sign documents, track their status, and ensure they are securely stored. This not only saves time but also reduces paperwork, making the tax filing process much more manageable.

-

Is support available if I have questions about the IRS 1040 SR printable form?

Yes, airSlate SignNow provides comprehensive customer support for any inquiries regarding the IRS 1040 SR printable form. Our support team is available to help you navigate through the platform, address any challenges you face, and ensure complete satisfaction. Don’t hesitate to signNow out for assistance!

Get more for Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code

- Final notice of forfeiture and request to vacate property under contract for deed nevada form

- Buyers request for accounting from seller under contract for deed nevada form

- Buyers notice of intent to vacate and surrender property to seller under contract for deed nevada form

- General notice of default for contract for deed nevada form

- Nv disclosure 497320466 form

- Sellers disclosure of financing terms for residential property in connection with contract or agreement for deed aka land 497320467 form

- Nevada statement form

- Notice of default for past due payments in connection with contract for deed nevada form

Find out other Form 1040 SR, U S Tax Return For Seniors Internal Revenue Code

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple